Accelerating Adaptation Investments for Resilient Infrastructure

Day 3, 6 May 2022, 1300 - 1400 IST

Context

The IPCC’s latest report on climate change impacts, adaptation and vulnerability delivered a clear message: there is a narrow opportunity to adapt to climate change and we need to act now. The anticipated costs of damages to infrastructure assets due to climate change are estimated to be as much as $22 billion per year by 2050 globally. Unreliable services due to disruptions in infrastructure networks will place an even greater burden on households and firms in low- and middle-income countries, with annual costs between $0.4 and 0.6 trillion every year. The combination of vulnerable infrastructure and increasing climate shocks can create an “infrastructure trap”: government are trapped into allocated limited budgets to building back damaged assets instead of building forward to bridge the infrastructure access gap. This has implications for countries achieving the Sustainable Development Goals (SDGs).

Countries need to ensure that infrastructure is resilient and that investments in infrastructure translate into resilient services. A key starting point is to assess how climate change will impact interconnected infrastructure systems at a national scale and to prioritize investments not just based on the cost of direct damages to assets but also to quantify how these damages affect people and services. This presents a challenge to ensure that existing infrastructure can withstand climate impacts, but it also provides an opportunity to learn from global experiences and to ensure that adaptation and resilience are reflected in all new investments in infrastructure going forward.

Purpose

The Ministry of Infrastructure and Water Management of the Netherlands and the Global Center on Adaptation (GCA) are jointly organizing this session to promote a High-Level Dialogue between governments, development partners and the private sector on accelerating adaptation investments in infrastructure for a climate-resilient future.

This session will draw from practical experience in mainstreaming adaptation into investments in infrastructure at scale, including GCA’s ambitious Africa Adaptation Acceleration Program (AAAP), which serves as a vehicle to mobilize $25bn for adaptation in Africa, and from partner experience in Europe, South Asia, and Small Island and Developing States.

Building on the key themes of ICDRI 2022, the high-level dialogue will explore three questions:

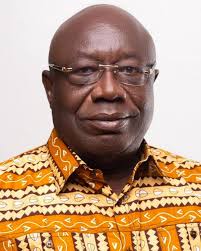

- How can countries put people at the center of infrastructure adaptation to ensure resilient assets translate into resilient services? Global estimates suggest that every $1 invested in resilient infrastructure can have up to $4 of benefits. Prioritizing targeted investments in infrastructure adaptation can reduce the cost of building resilience by 90% compared to an untargeted approach. The Netherlands and GCA are working with the Government of Bangladesh to assess climate risks to infrastructure, quantifying the impact to the provision of services at the household level and to the country’s development objectives. In Ghana, GCA, the government and partners, develop a roadmap of adaptation priorities to enhance the resilience of the country’s infrastructure.

- How can we leverage the nexus between infrastructure, Nature Based Solutions, and conservation to mainstream nature into resilient infrastructure? Unlocking capital for investment in nature-based assets is a global imperative that is gaining importance as the world faces the climate crisis. The UK COP26 Presidency highlighted the need for governments and businesses to mobilize finance in nature, with only 3% of global climate finance currently spent on nature-based assets. Nature-Based Solutions (NBS) are a cost-effective solution to enhance the resilience of infrastructure. However, despite evidence that green-grey solutions offer benefits to protect or substitute infrastructure assets and services, governments and the private sector struggle to structure NBS investments that demonstrate clear financial and economic returns.

- What are the innovative instruments required to finance resilient infrastructure? Climate-resilient infrastructure is quickly starting to be mainstreamed in general investment practice as institutions, organisations, and communities acknowledge the need to adapt to the impacts of climate change. For example, the EU Taxonomy (2020) established overarching conditions economic activity must meet to promote sustainability and the Climate Resilience Principles (2019) provide a framework to assess climate resilient investments. These frameworks are essential to ensure that public and private infrastructure investments achieve net-zero targets and development goals. However, there is the need to scale up adaptation investments in infrastructure and mobilize the private sector to bridge existing infrastructure gaps.

Speakers

Partner Organizations

.jpg)